Enterprise startups are boring. They’re not sexy, as evidenced by TechCrunch Disrupt last week, when only 3 enterprise startups were invited on stage (out of 30) . Mashable does not even cover them; perhaps because social, mobile and gadgets make much flashier headlines.

Yet, in the last 2 years, more than 70% of venture exits valued at over $500 million have been in the enterprise sector. Take a look.

Graphic: Marcus Wohlsen/Wired. Data: Renaissance Capital/Yahoo Finance.

The consumer market, we’ve been told by Ben Horowitz1 among others, is at risk for a bubble and Series A crunch (are consumer startups almost too easy these days?). Yet, the enterprise seems to be perfectly positioned in today’s technology market, primarily due to Moore’s Law, which states that processing power doubles every two years. The expansion of cloud computing has afforded enterprise startups a breakthrough: they no longer have to develop chips—simply pay as you go.

Software vendors’ offering low risk for big operations is only one reason enterprise startups are faring well. The boom of big data should not be overlooked for advanced B2B integration, nor should the fact that incumbent enterprise corporations have big problems and big money to spend for solutions.

The influx of capital enjoyed by many growing enterprise companies has not gone overlooked by IT engineers. A current pain point for companies in Silicon Valley is attracting top talent, yet a recent study by LinkedIN2 of the top 10 most in-demand tech startups shows a majority of IT engineers are drawn to enterprise jobs with Cloudera, Hadoop and other enterprise IT companies topping the list.

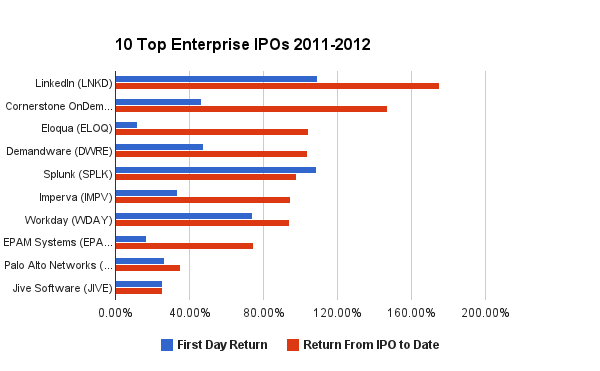

Truly, though, it’s about the exits. Where the exits go, the investors will follow. Of the aforementioned top 10 largest IPOs, every single one of them is trading above their offering prices. Take, for example, New Relic’s Ceo, Lew Cirne3 who said, “We have two customers paying us $1 million a year that started at $400 a month.” Compare this to consumer IPOs and you’ll see that only one in 10 have achieved what the market hoped they would do.

These statistics have not gone unnoticed. We’ve recently seen quite a few incubators and venture capital firms shift towards expanding their team and portfolios to enterprise investments. In 2012, 500Startups, Eric Ries and other well-known figures held the “UnSexy Conference” encouraging startups to look beyond their dorm room for inspiration. We also recently saw Jerry Chen of VMWare join Greylock just months after VMWare’s acquisition of Nicira for $1 billion.

Perhaps one of the most astonishing growth spurts in the enterprise startup sector has come from SAP, who, in just 18 short months, has scaled from 0 to 650 startups globally. Undoubtedly, SAP is attractive to startups due to their 40-year domain knowledge in enterprise and global presence as every enterprise startup should be thinking global from day one. They also grew this large ecosystem off their infrastructure offering,HANA , which offers infant startups corporate-level computing power.

The other, perhaps most refreshing, difference with enterprise startups is the maturity of the team. Vinod Khosla3 has famously stated “Leadership is coming from much younger people. I’m spending more time listening to people under 25 than I ever did before.” But this contradicts the enterprise strategy, which requires experience in the sector. Kaustav Mitra, mentor to over 650 enterprise startups at SAP, recently told me, “Founders typically skew older and usually come with a deeper domain knowledge.”

Therefore, enterprise startups may not be “all the rage.” They may never have the appeal of SXSW. They might even be middle-aged and dressed in skirts and suits (god forbid), but, they make money-lots of money. They’re outperforming consumer IPOs 2:1, and that’s damn sexy.

Sources:

(1) http://www.wired.com/business/2013/07/startup-reckoning/

(2) http://gigaom.com/2013/07/23/are-these-the-hottest-startups-around-or-the-next-billion-dollar-exits/

(3) http://www.infoworld.com/t/startups/are-we-in-enterprise-startup-bubble-223138?page=0,1

(4) http://www.businessinsider.com/vinod-khosla-young-entrepreneurs-2012-9#ixzz2fSFvBsIU